“It’s not what’s sent that matters—it’s what arrives, fully in INR, that determines your margin.”

In international remittances, especially for exporters, the total landed INR is the critical metric. This article digs deeply into Wise vs Bank SWIFT, using live data, typical SWIFT transfer charges, and realistic assumptions to show you which gives you more rupees when exporting — in full clarity.

How USD→INR Works: Key Components

To compare methods objectively, you must understand the pieces that reduce your payout:

- USD to INR exchange rate: This includes the base market rate (mid-market rate USD to INR) and any hidden markup imposed by the bank.

- Swift transfer charges: Fees charged for the use of the SWIFT network — outgoing fee from sender bank, possibly one or more intermediary banks, and receiving bank’s charge.

- Receiving bank costs / inward remittance charges: Once funds arrive, your Indian bank might charge a fixed fee plus apply its own spread.

Time & paperwork overhead: Delays, documentation (like FIRC / FIRA), and reconciliation effort affect cash flow.

What Exporters Should Look For

As an export business receiving international payments, you want:

- High effective USD→INR exchange rate (close to mid-market rate USD to INR)

- Low/transparent fees and no hidden SWIFT or intermediary deductions

- Speed (you want funds usable ASAP)

Reliable compliance documentation (FIRC / FIRA) for GST, audits, FEMA

Wise’s Model: Mid-Market Rate, Transparent Fees

Here is what recent data tells us about Wise’s USD→INR offering for India:

| Metric | Observed Wise Data |

| Live USD→INR exchange rate offered | ~ ₹88.1865 per USD when sending from US to India using ACH + Wise, with visible fees included. Wise |

| Fee for sending USD → INR via bank transfer | ~$11.72 on $1,000 (≈0.73%) when using bank transfer + Wise; less (~$7–8) via “connected bank account” options in some cases. Wise+1 |

| Transfer cost profile | Wise shows: “Total included fees (0.73%)” for $1,000 → INR. Wise |

| Rate guarantee / transparency | Wise uses mid-market rate and shows fee & net INR before confirmation. Wise+1 |

So, with Wise, you know upfront what “live USD→INR” you’re getting, and can use a Dollar to INR calculator (Wise’s built-in one or others) to preview landed rupees in your bank.

Bank SWIFT: Traditional Costs, Hidden Markups

Here’s what exporters often face when using conventional bank SWIFT wires:

| Cost Component | Typical Range / Sample Data |

| Outgoing USD bank fee (sender side) | $20–$75 depending on U.S. bank, amount, and whether wire is “urgent” or not. The Financial Express+1 |

| Intermediary / Correspondent bank charges | US→India transfers may pass through 1-2 intermediaries; each may take $10–$30. PayGlocal+1 |

| Receiving bank fee in India | ₹500-₹1,000 common; some banks charge less for normal business accounts, more for smaller/less frequent clients. Karbon Card+1 |

| Forex rate markup | 1.5-2.5% or more above mid-market rate USD→INR; banks may quote 82–86 when mid-market is 88. RemitBee+1 |

These add up, especially for larger sums. For exporters dealing with $5,000–$50,000 payments, these “hidden” deductions matter a lot.

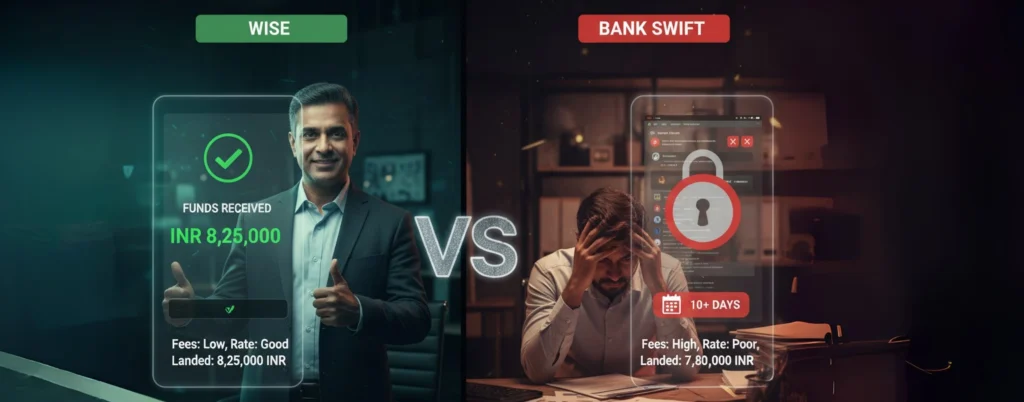

Full Comparison Table: What You Really Get (Examples)

Here are sample landed INR values for exports of $1,000 and $5,000 when you use Wise vs Bank SWIFT under realistic common bank fee assumptions. These assume live USD→INR mid-market ~ ₹88.18 (Wise data) Wise.

| USD Amount | Method | Assumed Fees / Deductions | Effective USD After Fees | Assumed USD→INR Rate | INR Landed | Difference vs Wise |

| $1,000 | Wise | ~$11.72 fee, no hidden spread, no intermediary deduction | $988.28 | ₹88.1865 | ₹87,100 | — |

| $1,000 | Bank SWIFT (typical bank) | $40 outgoing + $20 intermediary + ~2% rate markup (so rate ≈₹86.40 instead of 88.18) + ₹700 receiving bank fee | $940 equivalent after USD fees | ₹86.40 | ₹81,000-82,500 | ~₹5,000-₹6,500 less than Wise |

| $5,000 | Wise | Fee scales (~$30–$35) up front, mid-market rate used | $4,965 | ₹88.18 | ₹438,000 | — |

| $5,000 | Bank SWIFT (typical bank) | $50 outgoing + $30 set of intermediary fees + 2% rate markup + ₹1,000 receiving fee | $4,920 net post USD-side deductions | ₹86.40 | ₹425,000-₹427,500 | ~₹10,000-₹13,000 less than Wise |

Note: These are illustrative examples. Your exact landed INR will vary depending on which bank (sender & receiver) you use, how many intermediaries there are, and their rates. But the pattern is consistent: Wise gives significantly more INR for the same USD sent.

Hidden Costs You Must Know (Exporters Especially)

Wise vs SWIFT is not just about visible fees. As an exporter, you should watch out for:

- Exchange Rate Markups

Banks often present their USD→INR rate as competitive, but when you check live exchange rate USD to INR via Google/XE, you see the real mid-market rate. The difference between what bank gives you and mid-market is pure cost. - Multiple Intermediaries

If your USD wire goes through more than one correspondent bank, each may take a fee. Even if your bank says fees are inclusive, you may see deductions bounced off your amount. - Receiving Bank’s Charges

Even after conversion, Indian banks may charge for remittance credit or inward remittance processing. Also, they may apply their own marginal rate. Sources suggest many banks have a 1-2% markup when converting & incoming processing for export receipts. Karbon Card+1 - GST / Regulatory / Compliance Overheads

Documentation (FIRC / FIRA) may attract fees. Also, reconciling bank statements vs invoices if rate differences are large uses time and sometimes cost (accountant fees). - Delay Cost

With SWIFT, delays can be several business days. If export payments are expected to pay for inputs, labour, logistics, a delay of 2-3 days costs in opportunity (interest, supply chain) as compared to faster Wise settlement.

Settlement Time, Compliance & FIRC Considerations

| Factor | Wise | Bank SWIFT |

| Settlement Time | Often same-day or within T+1 business day in many USD→INR flows through Wise, depending on method. Data shows transfers arriving very quickly when using connected / ACH methods. Wise | Typically T+2 or T+3 for bank wires, sometimes longer if compliance or correspondent banks involved. Delays for FIRC issuance are common. |

| FIRC / FIRA Documentation | Wise provides transparent remittance advice; you can download, and often automatically generated. Good for export compliance. | Banks issue Foreign Inward Remittances Certificates / advice, but often with delay; may require formal request. Delays impact claiming benefits or reconciliations. |

| Predictability | Since fees & rate are upfront, you know what INR will land. Using Dollar-to-INR calculator with Wise, you can simulate ahead. | Less predictable: rate differences may appear only on actual settlement; unexpected intermediary deductions may crop up. |

Use-Case Scenarios: When Bank SWIFT Might Be Okay

Even though Wise often wins on landed-INR, there are cases where Bank SWIFT might make sense:

- Very large amounts, where banks might offer negotiated rates or lower markups (if you’re a key exporter or have high volume).

- When the buyer insists on sending via SWIFT and pays the sender fees + OUR charge (meaning recipient doesn’t bear intermediary costs) — but you’ll still likely lose due to bank’s rate margin.

- New export markets where exporter bank doesn’t partner well with platforms like Wise. If your bank has special remittance tie-ups, that might reduce correspondent fees.

Regulatory / banking requirements: If for some reason a specific bank or branch is mandated by your export documentation or is more familiar with your documentation for audit (though this is less of a differentiator now).

What Should You Do Next (Actionable Checklist)

Here is a refined checklist for your export business to maximize landed INR when choosing between Wise vs Bank SWIFT:

| Step | Action |

| 1 | Use a Dollar-to-INR calculator (use Wise’s or any reputable one) to simulate both methods for your typical USD amounts. |

| 2 | Ask your bank for their USD→INR rate quote and compare to live-market/mid-market rate USD to INR. Watch for “bank charges + spread” vs what you see. |

| 3 | Verify all fees: outgoing wire, intermediary, receiving bank, and any documentary fees (for FIRC). |

| 4 | Insist where possible on OUR charge type if you’re paying the sender, to avoid recipient bearing intermediary fees. |

| 5 | Check how quickly FIRC / export documentation will be made available. Delays can cost in cash flow. |

| 6 | For large recurring export payments, negotiate with either your bank or provider (Wise or otherwise) for better rates or reduced fees. Volume gives negotiation power. |

| 7 | Maintain historical records of landed INRs for each method — this builds your internal base rates so you can estimate better next time. |

Final Comparative Summary & Recommendation

| Key Factor | Winner / Lean | Why |

| Landed INR for standard export amounts | Wise | Using live USD→INR rates, transparent fees, virtually no intermediary deductions. |

| Predictability & cash flow | Wise | You know what you’ll get before confirming. Bank SWIFT has uncertainty in rate & fees. |

| Large/negotiated bank relationships | Possibly Bank SWIFT | If you export at high volume and have bank negotiating power, you may get better bank-rates. |

| Export documentation & FIRC | Tie | Both can provide documentation; Wise tends to be faster and more automated; bank SWIFT may involve manual requests. |

| Speed | Wise | Usually T+1 or same-day for many USD→INR flows; SWIFT often takes 2-3 business days, more if delays or intermediaries. |

Conclusion: After Wise vs SWIFT, choose the rail that maximises landed INR—purpose-built for Indian exporters

Your comparison of Wise’s mid-market + fee model versus bank SWIFT with intermediary deductions and rate markups answers the first question: which method leaves more rupees in your account today. The next question is bigger: which rail gives you consistently higher landed INR, faster turnarounds, and cleaner compliance as you scale exports?

That’s where HiWi Pay fits—an exporter-first payout layer engineered for India’s SMEs and B2B trade:

- Bank-grade, RBI-aligned flows with no buried spreads—clear, lower FX markups than typical bank rates and many providers.

- 24-hour INR credit on eligible payouts to keep inventory, ads, and supplier payments moving.

- Free global virtual accounts (USD/EUR/GBP, etc.) to collect abroad and settle locally—managed end-to-end in a mobile app (no branch visits).

- Invoice-matching & live tracking so finance teams see every payment’s status and reconciliation in real time.

- Smart document guidance (FIRC/e-FIRA, e-BRC and supporting proofs) so money moves compliantly without back-and-forth.

- One-to-one expert support, built around the realities of export cash flows—not generic ticket queues.

- Product vision led by Dewan Neralla (who helped scale Atom Technologies and NTT DATA Payments), bringing hard-won payments rigor to a secure, fast, reliable rail for exporters.

Bottom line: Wise can be transparent; SWIFT can be familiar. HiWiPay is purpose-built—combining exporter-friendly FX, RBI compliance, 24-hour settlement, and audit-ready docs to protect margin and accelerate cycles. If “total landed INR” is your north star, make your next payout the test: run it through HiWi Pay and measure what truly arrives—more, sooner, and with fewer surprises.