Somewhere in Mumbai, a founder is exporting software to four countries, managing payroll in three currencies, and closing clients over WhatsApp at 2 AM.

Yet to open a foreign payment account, she still has to print forms, sign in blue ink, and courier them to a branch. The same bank that calls itself “digital-first” asks for her electricity bill.

That contrast — a 21st-century business stuck inside a 20th-century process — is exactly what HiWiPay set out to end.

Because in 2025, no one building for the world should have to wait for permission to get paid by it.

The Bottleneck Exporters Forgot To Challenge

Ask any exporter what slows them down, and they’ll say documentation, compliance, maybe GST refunds. Almost no one says onboarding — until they experience it again.

The truth is, account setup is still the most outdated part of cross-border trade. It’s the one step that hasn’t evolved in two decades.

HiWiPay redesigned that moment from scratch. No relationship managers. No ticket numbers. No forms that pretend to need a signature when an API call will do.

You go from application to activation in 15 minutes.

Not because it’s “fast,” but because it’s engineered like a product, not a process.

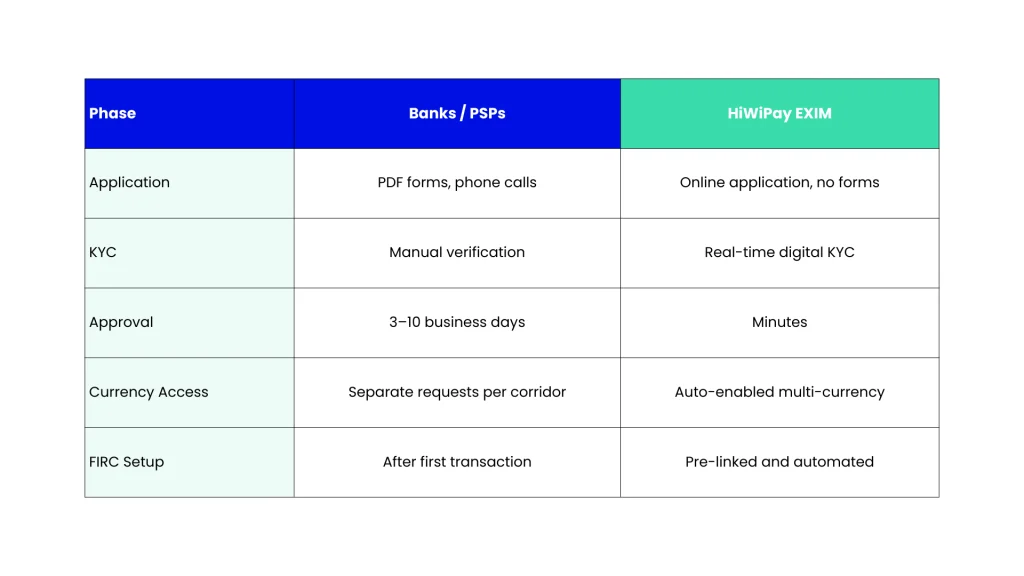

How The Rest Of The Industry Still Onboards

Legacy banks and PSPs call it “compliance.” Exporters call it inertia.

HiWiPay doesn’t simplify onboarding. It redefines what onboarding is.

15 Minutes That Change Everything

You start the process with your GST and PAN.

HiWiPay verifies your business identity, assigns your RBI purpose codes, and creates your virtual accounts in USD, EUR, and GBP — in one motion.

The first payment you receive already carries the compliance architecture older systems make you apply for.

One user put it this way:

“The setup took less time than it takes to explain my workflow to my banker.”

That’s not marketing. That’s what happens when onboarding is treated like UX, not paperwork.

The Real Point Isn’t Speed. It’s Certainty.

With HiWiPay, the waiting disappears — but so does the uncertainty. You know exactly how long activation takes, exactly what’s required, and exactly when you can start invoicing in foreign currency.

There’s no back-and-forth, no follow-up, no “status check.”

Just progress you can see in real time.

That’s what “15 minutes” really means: an entire process finally measurable, predictable, and transparent.

The Verdict

HiWiPay doesn’t beat banks by being faster. It beats them by finally matching the way modern exporters already operate — digital, global, immediate.

It’s the difference between filling forms and flipping a switch.

Between waiting for access and being in business.

Onboarding isn’t a ceremony anymore. It’s just the start button.

About HiWiPay EXIM

HiWiPay EXIM is India’s purpose-built export payment infrastructure for service exporters, freelancers, and agencies who outgrew traditional banking long ago. It runs on JPMorgan’s global settlement rails, designed under RBI oversight, and led by fintech pioneer Dewang Neralla, the architect of Atom Technologies and NTT Data Payments.

HiWiPay unifies everything an exporter needs — live FX conversion, compliance tagging, and settlement visibility — inside one system that works at the speed of digital business.

The onboarding is fully automated: digital KYC, instant purpose-code configuration, multi-currency account activation, and immediate access to INR settlement corridors. Every transaction comes pre-linked to a digital FIRC and purpose code, ensuring compliance from day one.

HiWiPay EXIM is what export finance looks like when it’s built for builders — fast, verified, compliant, and completely under your control.