It starts the same way it always does — not with a failure, but with fatigue.You’re not angry at Payoneer or Wise; you’re just tired of waiting for things that should already work.

The five-day settlements. The exchange rates that never quite match what you saw online. The FIRCs that arrive like postcards from another century.You don’t switch platforms because something breaks. You switch because you’ve outgrown compromise.

That’s where HiWiPay enters — not as a competitor, but as the logical next chapter in how Indian exporters, agencies, and freelancers run global payments.

This isn’t a tutorial. It’s a handover — from the old world of delayed transparency to the new one built around live FX, RBI compliance, and total control.

Why People Move

Most users don’t abandon Wise or Payoneer overnight. They do it after one too many “in progress” emails, one too many support loops, one too many conversations with accountants who can’t download a single digital FIRC.

They move because:

- Exchange rates hide invisible spreads.

- FIRC turnaround takes days, if not weeks.

- Compliance queries stall refunds.

- Support SLAs stretch longer than settlements.

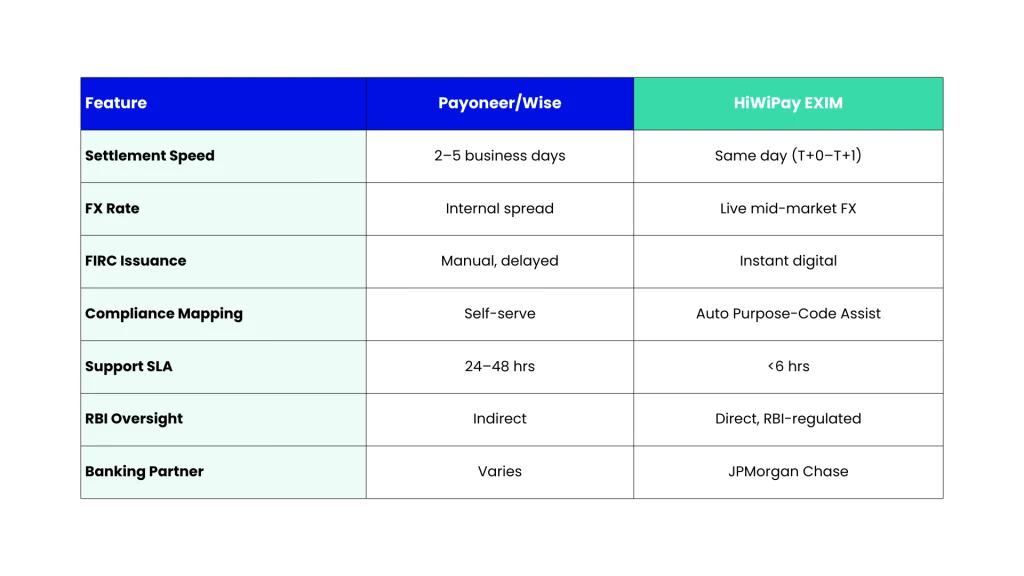

HiWiPay solves all four — not through perks, but through architecture.

Every transaction runs on JPMorgan’s global banking rails, converting at live mid-market FX rates, issuing digital FIRCs instantly, and clearing INR in T+0 to T+1.

That’s the difference between platforms built to serve millions and one built specifically for Indian exporters.

Before You Begin: What You’ll Need

Migrating takes less time than your old platform’s payout cycle.

Here’s what to keep handy:

- GST certificate or business registration

- PAN and one ID proof

- Bank account details for INR settlements

- Your existing Payoneer/Wise client payment references (for linking continuity)

HiWiPay’s digital onboarding takes about 15 minutes, verified through DigiLocker and RBI-approved KYC partners.

Once you’re verified, your virtual accounts in USD, EUR, GBP and 20+ other currencies activate instantly — ready to receive your next invoice.

Step-by-Step Migration

Step 1: Create Your HiWiPay Account

Visit https://www.hiwipay.com/ and sign up using your business credentials. The platform will auto-detect your entity type (freelancer, LLP, private limited, or proprietor).

Step 2: Complete Digital KYC

Upload your documents directly through the portal — no physical forms, no branch visits. Verification happens in real time.

Step 3: Link Your INR Bank Account

Choose any Indian bank account where you want settlements to land. HiWiPay integrates seamlessly with ICICI, HDFC, Axis, SBI, and all scheduled commercial banks.

Step 4: Generate Your New Receiving Accounts

Within minutes, you’ll see your unique USD, EUR, and GBP virtual account details under your dashboard — powered by JPMorgan Chase. Share these with your international clients.

Step 5: Redirect Future Payments

Update your payout details on Upwork, Fiverr, or direct invoices. Replace Payoneer/Wise bank info with your new HiWiPay virtual account.

Once the client pays, the amount routes directly into your HiWiPay account, converts at live mid-market FX, and credits INR within hours.

Step 6: Download Your FIRC

Your digital FIRC appears automatically on your dashboard — timestamped, purpose-coded, and RBI-compliant. No ticket. No follow-up.

Step 7: Inform Clients (Optional)

If you’re migrating mid-cycle, send your clients a short note mentioning that your new receiving account is now active through HiWiPay’s JPMorgan network. It’s globally recognized and doesn’t affect their payment method.

What Changes Immediately

- Faster Settlements: T+0 to T+1 vs 3–5 days with Payoneer/Wise

- Transparent FX: Live mid-market rates, not internal “bank rate India”

- Instant FIRCs: Auto-generated, RBI-approved

- Dedicated Support: Average response <30 minutes, resolution <6 hours

- Purpose-Code Assist: No manual dropdowns, no compliance confusion

Migration doesn’t just change platforms. It changes rhythm.

Real Story: When Waiting Became Optional

A design agency in Pune used to collect $30,000 a month through Wise. They averaged four-day settlements and spent hours chasing FIRCs for GST filings.

After migrating to HiWiPay, they received their first USD inflow in six hours flat.

The FIRC appeared on the dashboard automatically.

No follow-ups. No stress.

As their founder put it:

“I didn’t feel like we switched platforms. I felt like we stopped waiting.”

What You’ll Notice Next

After the first few settlements, three subtle but powerful changes appear:

- Your accountants stop complaining. Every export receipt is already FIRC-mapped.

- Your cash flow graph stops staggering. Settlements are rhythmic, not random.

- You stop checking for confirmation emails. You just know when the money will hit.

The migration doesn’t just give you control. It gives you peace.

Common Questions About Switching

Will my clients have to change their payment process?

No. They’ll still pay via bank transfer, just to your new JPMorgan-backed virtual account.

Is HiWiPay approved by RBI?

Yes. HiWiPay EXIM operates through RBI-regulated AD-II partners, ensuring full FEMA and EDPMS compliance.

Do I lose historical data from Payoneer/Wise?

No. You can keep your past reports for audits. HiWiPay helps you generate unified reports going forward.

Can I run both systems during transition?

Yes. You can keep Payoneer/Wise live while new clients start paying via HiWiPay. The switch is seamless.

Why HiWiPay EXIM Exists

Global payments shouldn’t feel foreign.

HiWiPay EXIM was created to make export receipts behave like domestic transactions — real-time, RBI-clean, and effortless. Built by Dewang Neralla (ex-Atom Technologies & NTT Data Payments) and powered by JPMorgan Chase, the platform combines enterprise-grade infrastructure with the speed and clarity small exporters have never had.

You don’t “open” an account here. You turn one on.

Your first inflow proves the point: no conversion delay, no mystery deductions, no support tickets for FIRCs.

HiWiPay EXIM is where money finally starts behaving like data — instant, traceable, compliant.

The Verdict

Switching from Payoneer or Wise to HiWiPay isn’t about chasing a better rate. It’s about aligning your payment system with the pace of your business.

The process takes minutes. The difference lasts years.

Because in a world where everyone promises “fast,” HiWiPay is the first platform that makes fast feel natural.