PayPal was the first passport Indian agencies ever owned.

Long before the fintech wave, before dashboards, before T+0 became a thing, it was PayPal that made “foreign client” sound real. You’d get that email, “You’ve got money” and for a second, it felt like the world was smaller.

But nostalgia has exchange rates too.Because what started as freedom now often feels like friction: deductions you never factored, taxes you never expected, and compliance you never signed up for.

The question isn’t whether PayPal worked.It’s whether it still works for you.

1. How Agencies Actually Use PayPal

For small and mid-sized agencies—design, IT, marketing, content—PayPal became the go-to because it just worked.

Clients could pay with a card, you got INR in a few days, and everyone moved on.

Until you realised how much “a few days” and “a few percent” actually cost.

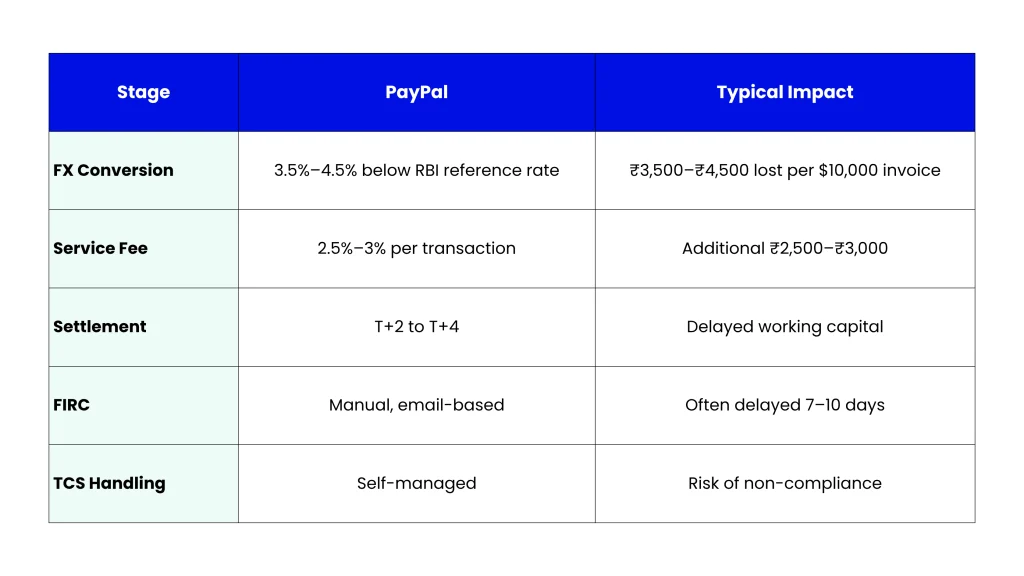

Here’s the invisible math most agencies miss:

That’s roughly ₹6,000–₹8,000 gone before you even count GST or tax collected at source (TCS).

2. The TCS Tightrope

Under Section 206C (1G) of the Income Tax Act, payments received from abroad can attract TCS (Tax Collected at Source) when processed through certain channels.

The issue? Many agency owners don’t even realise they’re triggering it—because their payment partner doesn’t clarify the purpose code or category properly.

This confusion often leads to double taxation, delayed refunds, and mismatched entries during annual filings.

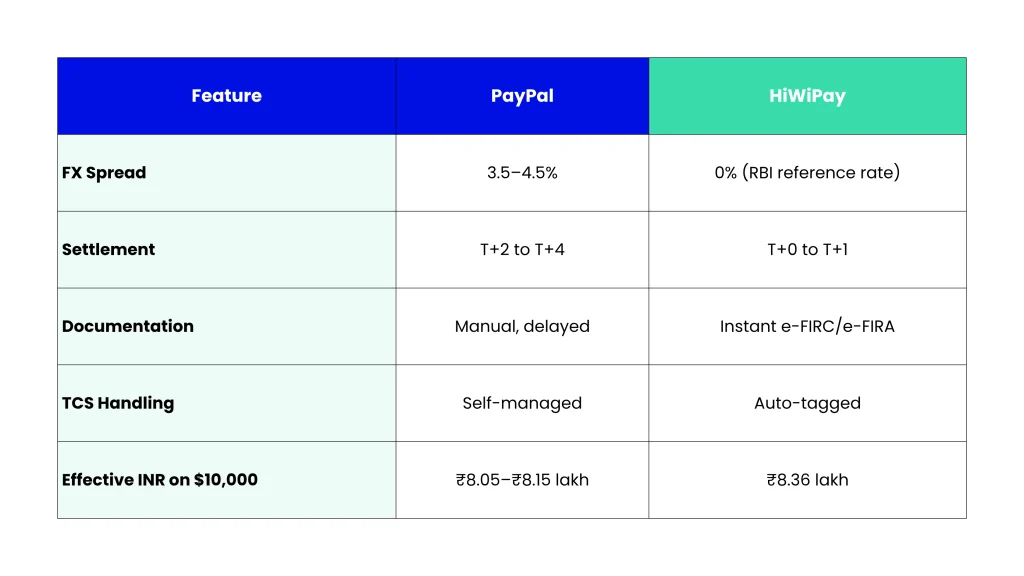

HiWiPay’s system solves this by tagging every inward remittance with the correct RBI purpose code and maintaining ready FIRC/e-FIRA records, making compliance part of the payment itself—not an afterthought.

3. HiWiPay: Where Math Meets Meaning

HiWiPay was built for the Indian agency that’s global by reach but still local in reporting.

It processes your client’s payments through RBI-regulated channels, converts at the RBI reference rate (no FX markup), and settles in your Indian bank within T+0 or T+1.

Every transaction auto-generates e-FIRC/e-FIRA, integrates with Tally or Zoho, and ensures TCS alignment through accurate purpose coding.

With HiWiPay, what you earn and what you receive finally become the same sentence.

4. The Cost of Familiarity

PayPal built trust.

But trust doesn’t have to mean tolerance.

Most agencies don’t switch because they’re afraid of complexity.

Yet HiWiPay’s onboarding takes under 15 minutes—no RBI maze, no paperwork fatigue.

You keep the global credibility, minus the silent spreads and endless FIRC emails.

Because sometimes evolution isn’t rebellion—it’s refinement.

5. The Documentation Divide

The difference between a “payment received” and a “compliant remittance” is paperwork—and that’s where most agencies trip.

PayPal sends FIRCs through partner banks manually. HiWiPay automates the entire trail.

Every export receipt, purpose code, and FIRA is timestamped and stored inside your dashboard.

That means less “please resend this” and more “we’re already done.”

Full Circle

For Indian agencies, PayPal was the doorway to the world.

HiWiPay is the hallway that connects every room.

It doesn’t rewrite the story—it finishes it.

Because the goal was never just to get paid.

It was to get paid properly—without losing time, proof, or peace along the way.

About HiWiPay EXIM

HiWiPay EXIM gives Indian agencies and service exporters a faster, clearer way to receive international payments—built on RBI compliance, zero-forex-markup FX, and auto documentation that satisfies both clients and auditors. With global virtual accounts powered by JPMorgan Chase, HiWiPay ensures that every dollar you earn lands in India complete—with its proof, purpose code, and predictable INR value intact. Founded by Dewang Neralla (ex-Atom Technologies, NTT Data Payments), HiWiPay EXIM is helping Indian agencies reclaim the margin between effort and earning.