If you trace an exporter’s day on a graph, it wouldn’t chart profit, rather, it would chart time.

Time between invoice and credit.Time between an email marked payment sent and an INR notification that finally confirms it.Platforms like Payoneer helped smooth that curve — fewer steps, fewer surprises.But sometimes, even smooth can still be slow.

HiWiPay isn’t about cutting corners.It’s about cutting time and giving that time back to your business.

1. What the Clock Really Costs

Payoneer’s appeal is clear: it connects easily with freelance platforms, global clients, and digital marketplaces.Funds collect in a Payoneer wallet, convert when you withdraw, and reach your bank in a few days.

But inside that clean process live small fragments of delay:

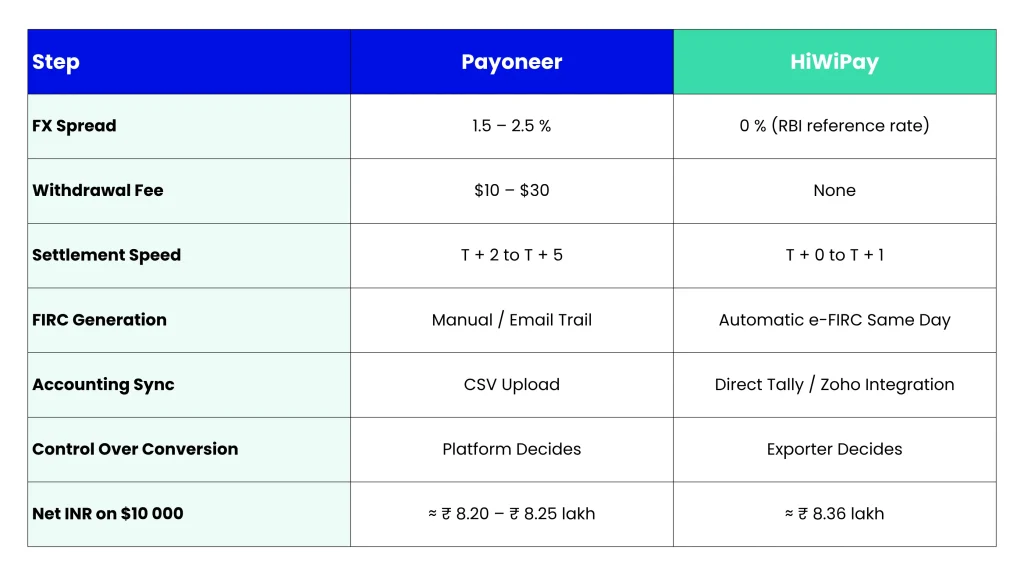

- Conversion spread of 1.5–2.5 % below the RBI reference rate.

- Withdrawal fee of $10–$30, depending on corridor.

- Settlement window stretching from T + 2 to T + 5.

Individually, none of these hurt. Together, they bend your timeline and your landed INR, just enough to notice.

2. HiWiPay’s Approach: Direct, Dated, Done

HiWiPay’s design begins where most exporters feel the lag.

Payments flow into global virtual accounts powered by JPMorgan Chase, convert at the RBI reference rate, and reach your INR account within T + 0 or T + 1.No conversion markup, no per-withdrawal fee, no waiting for “transfer available.”

Every transaction auto-generates its e-FIRC/e-FIRA, tags the correct RBI purpose code, and syncs with your books in real time.

The gain isn’t just a higher landed INR, it’s the restoration of rhythm.Your payment finishes the same day your project does.

3. When Time Turns Into Working Capital

Three extra settlement days on ₹8 lakh might not sound like much until you multiply it across ten clients.That’s nearly a week of liquidity frozen somewhere offshore.

HiWiPay’s T + 0 to T + 1 cycle doesn’t merely feel faster; it keeps cash in circulation, funding new work without borrowing against tomorrow.It’s a small operational difference that compounds like interest.

4. Accounting That Balances Itself

Every exporter knows the reconciliation spiral: one payment, three spreadsheets, four emails.

HiWiPay flattens that entirely.Each receipt is paired with its invoice, timestamped, and visible inside Tally, Zoho, or QuickBooks before your accountant even asks.

Compliance stops being an end-of-month project and becomes part of the payment itself.

5. Predictability Is the New Efficiency

The real comparison between HiWiPay and Payoneer isn’t about who’s faster or cheaper; it’s about who’s consistent.

Payoneer gives predictability at the collection stage.

HiWiPay extends it to the realization stage, the moment INR hits your ledger, already documented and ready to audit.That continuity is what lets exporters plan confidently instead of reactively.

If you plot that exporter’s graph again, invoice to credit, send to settle, you’ll see something subtle.The curve hasn’t just flattened.It’s synced.HiWiPay doesn’t erase the time between earning and receiving.It simply returns it to you as working capital, as clarity, as calm.

About HiWiPay EXIM

HiWiPay EXIM is rethinking how time moves in cross-border payments. Built for Indian exporters, agencies, and freelancers, it shortens the gap between earning and receiving with RBI-compliant global accounts, instant e-FIRA/e-BRC, and zero-markup FX at the RBI reference rate. Backed by JPMorgan-powered infrastructure, and supported by VC investors with ex-RBI leadership, HiWiPay EXIM turns every transaction into what it should be — fast, documented, and dependable.