It starts innocently.

You open a multi-currency dashboard and see $25,000 sitting there. The chart looks good today, but tomorrow’s rate might be better. You tell yourself you’re being strategic, not hesitant. You’ll convert when the dollar peaks.

Days pass. The market moves. By the time you finally hit “convert,” you’ve lost ₹1.20 on every dollar.

That’s the hidden trap of holding foreign currency—it feels like control, but it’s actually speculation disguised as patience.

HiWiPay exists to take that risk off your desk.

The Psychology of “Holding”

Every exporter who uses multi-currency accounts says the same thing: “I want flexibility.”

What they really mean is, “I don’t trust the rate today.”

But FX doesn’t reward intuition. It rewards timing, data, and infrastructure. Holding funds in USD or EUR may look safe, but it quietly exposes you to:

- Exchange rate risk — value swings that can wipe margins overnight.

- Liquidity risk — working capital trapped in another currency.

- Compliance risk — delayed conversion complicates RBI reporting and FIRC generation.

The irony is, the very act of waiting for a better rate often costs more than any fee.

When “Flexibility” Turns Into Leakage

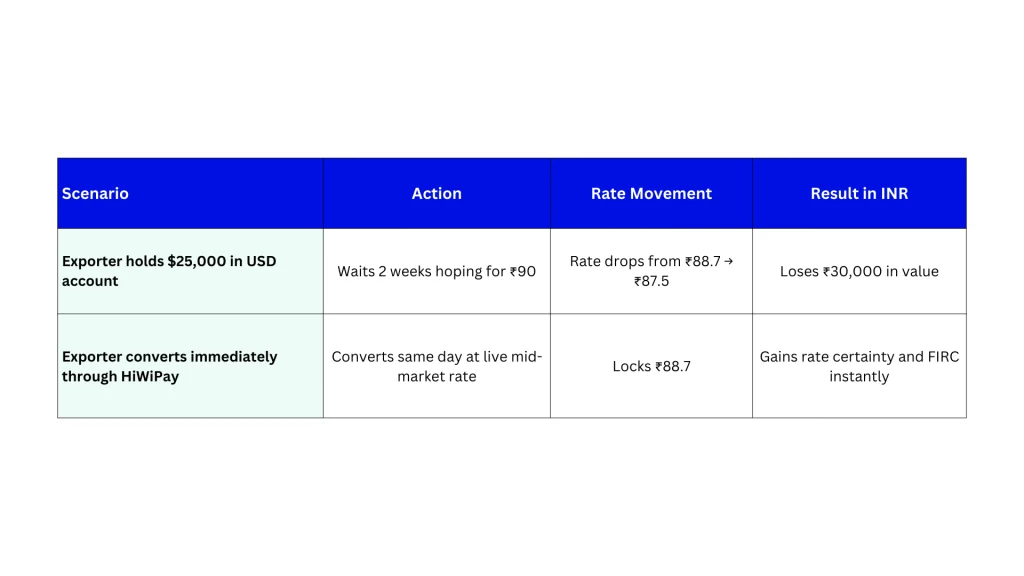

Here’s what actually happens:

That 1.2-rupee drop doesn’t look dramatic on a screen, but it’s ₹30,000 gone for doing nothing.

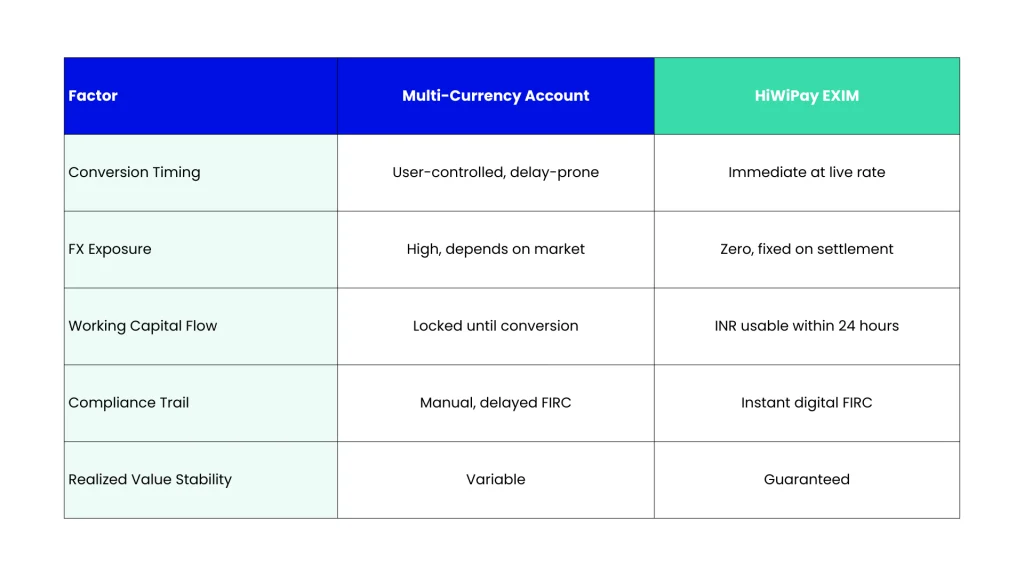

HiWiPay removes this volatility entirely. The platform settles exports at the live mid-market rate, credits INR within 24 hours, and auto-generates FIRC. No FX gambling. No conversion delays. No paperwork pile-up.

The Risk You Can’t See: Compliance Timing

Every time an exporter holds currency abroad, the RBI clock starts ticking. FIRCs and e-BRCs depend on realized value, not parked balances. The longer you delay conversion, the longer your compliance documents stay incomplete.

That might not sound urgent—until a refund claim or audit demands proof of realization. Multi-currency accounts make it look like your funds are safe. In reality, your documentation is frozen.

HiWiPay’s settlement model keeps every transaction RBI-aligned by converting instantly and issuing digital FIRC on the same timeline.

A Founder’s Lesson

A Chennai SaaS startup held $100,000 in a USD account for “the right rate.” Over three months, the rupee strengthened by ₹1.6. They lost ₹1.6 lakh before realizing they’d effectively become FX traders by accident.

They switched to HiWiPay. Every client payment now converts automatically. No timing decisions, no risk, just predictable INR on the books.

As the founder put it, “We stopped chasing cents and started planning in rupees.”

The Verdict

Multi-currency accounts promise control. What they really offer is responsibility for something you can’t predict.

HiWiPay replaces timing with certainty. The system converts every payment at live interbank rates, settles instantly, and generates your compliance trail in the same motion. You don’t “manage FX.” You simply get paid—accurately, compliantly, and on time.

In a business where margins live or die by one rupee, that isn’t convenience. It’s protection.

About HiWiPay EXIM

HiWiPay EXIM is India’s export payment infrastructure built for businesses that want stability, not suspense. It converts global earnings into INR at real-time mid-market rates with transparent pricing and no hidden spreads.

Each transaction runs through a JPMorgan-powered settlement network, supervised by an ex-RBI director, and led by fintech pioneer Dewang Neralla—the mind behind Atom Technologies and NTT Data Payments.

HiWiPay’s system eliminates conversion timing risk by automating settlement, locking rates at the point of receipt, and generating FIRCs instantly. Exporters no longer juggle market charts or compliance dates. They see one dashboard showing every invoice, every conversion, every document—ready for banks, auditors, and refunds.

HiWiPay EXIM turns cross-border payments into something they’ve never been before: simple, immediate, and fully predictable.