For decades, international payments ran on a simple handshake.You’d walk into your bank, meet your relationship manager, sign a few forms, and trust that your client’s dollars would find their way home. It was personal. Predictable. Human.

That handshake still matters, it built the trade economy we stand on.But as business scales and borders blur, exporters have begun asking a quieter question:

Does trust have to come at the cost of time?

1. How SWIFT Still Works — and Why It Always Will

SWIFT isn’t broken; it’s just built for another era. Every transfer travels through a network of correspondent banks — each confirming, charging, and passing the baton to the next. It’s safe, traceable, and globally accepted.

But each checkpoint adds a few things:

- Intermediary fees (₹700 – ₹2 000 per transaction)

- Two to three days of settlement time

- Emails and forms for every compliance document

It’s a dependable system that moves like a parade — never lost, rarely fast.

2. Why Exporters Still Rely on Their RMs

Because a good RM doesn’t just process transfers. They translate confidence.They know your account, your history, your margins. They can call the treasury desk for a better rate or help when a FIRC goes missing.

That relationship is real and irreplaceable.But what happens when your business outgrows the need for a phone call every time money moves?

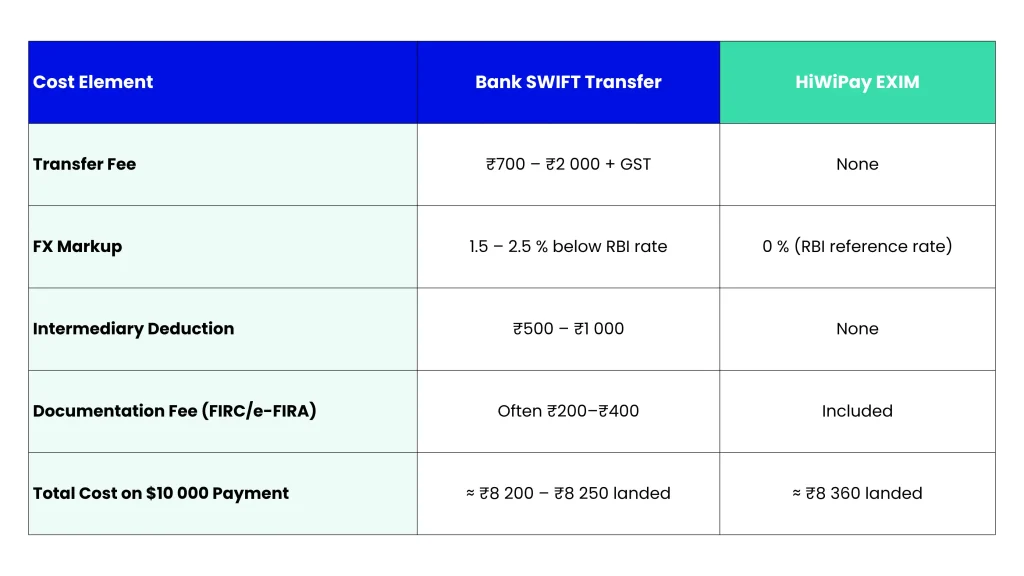

3. The Cost Layer: What Each Path Really Costs

Banks charge for certainty.HiWiPay builds certainty into the system itself.

4. The Speed Layer: From T + 3 to T + 1

A SWIFT payment typically follows a T + 2 – T + 3 timeline — depending on cut-off hours and intermediary routing.HiWiPay settles within T + 0 – T + 1, directly into your INR account, powered by JPMorgan Chase rails.

That difference of 48 hours may seem small, but to an exporter running monthly cycles, it’s the gap between reacting and reinvesting.

5. The Documentation Layer: Proof Made Practical

In the SWIFT world, a payment isn’t finished until the FIRC arrives — often after a round of branch emails and scanned PDFs.HiWiPay treats compliance as part of the payment: every transaction auto-generates e-FIRC/e-FIRA, tags the correct RBI purpose code, and keeps everything in one digital ledger.

So when your accountant asks, you don’t search; you click.

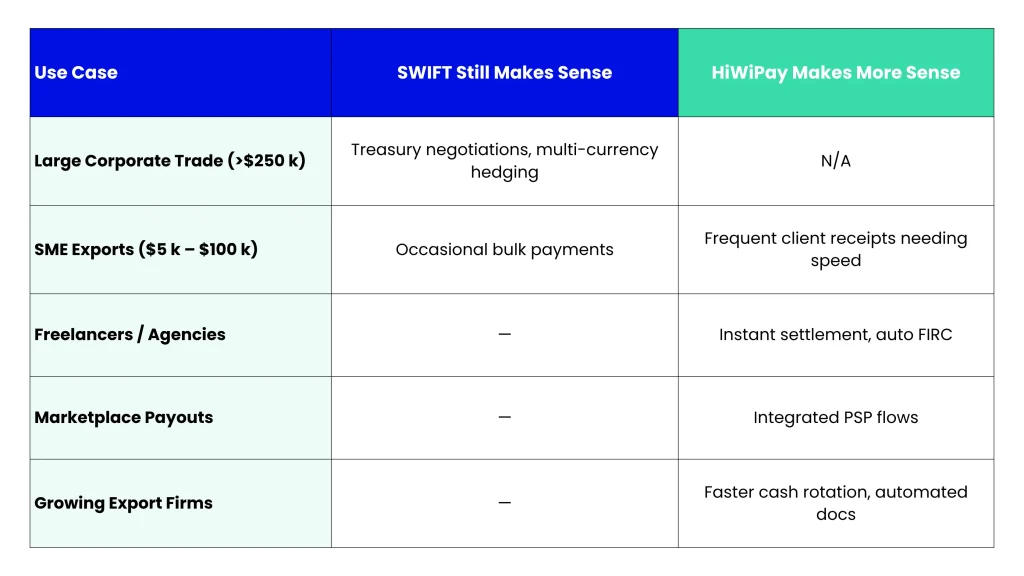

6. When to Switch — and When Not To

You don’t replace your RM. You simply stop depending on one for what software can do better.

7. The Shift from Trust to Transparency

SWIFT gave exporters trust, a system backed by banks and signatures. HiWiPay adds transparency ; the ability to see, verify, and reconcile everything in real time.

It’s not a rebellion against tradition; it’s its continuation, redesigned for scale.

Full Circle

The handshake isn’t going away. It’s just moving online.Where your RM once stamped your form, your dashboard now timestamps your settlement.The relationship stays, the waiting doesn’t.

Because money should still travel with confidence, just no longer at walking speed.

About HiWiPay EXIM

HiWiPay EXIM bridges the tradition of banking with the tempo of modern trade.Built for Indian exporters, service firms, and freelancers, it delivers RBI-compliant cross-border payments, T + 0 settlement, and instant e-FIRC/e-FIRA — all powered by JPMorgan Chase’s global network. Guided by VC investors with ex-RBI leadership, HiWiPay EXIM combines trust, transparency, and technology so your business never waits for what it’s already earned.