Money moves like light through fog.

You can see it leave one end of the world, but you never really know when or how it will reach the other.

The bank says T+2.

The fine print says maybe.

And exporters, somehow, are still told to be patient.

That’s the paradox of global trade in 2025. The internet can deliver a film across oceans in seconds. A freelance designer in Delhi can collaborate with a studio in Paris in real time. But when it comes to getting paid for that work, time still slows down.

A $10,000 wire can vanish for four days. A transfer marked “complete” in New York can take a week to reflect in Mumbai. And no one can tell you exactly where it went in the meantime.

It’s a system that rewards endurance instead of efficiency.

HiWiPay was built for exporters who stopped finding that acceptable.

Because this isn’t just about faster payments. It’s about reclaiming time — the one currency you can’t hedge.

I. Time As The Real Hidden Fee

Every exporter understands cost. They plan around freight, packaging, tax, and margin. But few calculate the cost of waiting.

When a bank tells you T+3, it’s not a number — it’s a holding pattern. It means three business days if everything goes perfectly: no intermediary delays, no compliance pauses, no weekend cutoff, no timezone mismatch.

In reality, it’s more like T+3 to T+7.

And during that time, your capital is neither lost nor usable. It’s invisible.

That invisible period is what kills working capital cycles.

- Payrolls get pushed.

- Vendors wait.

- Refund claims delay.

- Confidence erodes quietly, invoice by invoice.

Exporters rarely notice this decay because it’s gradual. But in a $100,000 monthly inflow, even a two-day delay freezes ₹18–20 lakh in value.

That’s not liquidity management. That’s enforced stagnation.

HiWiPay’s settlement SLA — T+0 to T+1 for USD, EUR, and GBP corridors — was engineered to cut this waste out completely.

Time shouldn’t be a variable. It should be a guarantee.

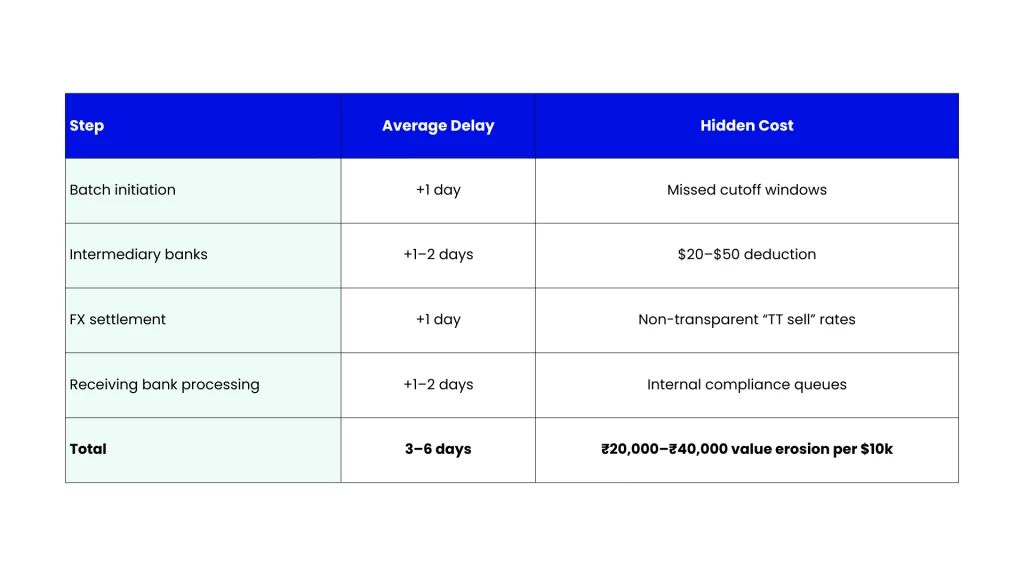

II. The Anatomy of a Bank Delay

Let’s trace what really happens behind a standard “international transfer.”

- Client initiates transfer: Their bank processes it in batches at the end of the business day.

- Correspondent routing: The payment passes through one or two intermediary banks, each deducting handling fees and compliance checks.

- Currency conversion: Often delayed until the receiving bank decides which day’s rate to apply.

- Compliance and settlement: The local bank verifies the sender, reconciles documents, and only then credits your account.

- FIRC generation: Another waiting game, often manual, triggered days after credit.

Every stage introduces friction that’s invisible to the sender and unbearable to the receiver.

HiWiPay rebuilt the stack.

It connects directly to global settlement rails via JPMorgan Chase, skipping intermediary chains altogether. FX conversion happens in real time at the mid-market rate, and settlements clear within hours — not business days.

You don’t wonder where your money is. You watch it move.

III. Predictability > Speed

“Faster” is not always “better.” Every exporter has experienced that moment when a fintech promises instant credit — only for compliance to freeze it later.

HiWiPay’s edge is not speed for speed’s sake. It’s predictability by design.

Each corridor runs on a fixed SLA:

- T+0 (same-day) for USD settlements.

- T+0 to T+1 for EUR and GBP corridors.

- Full settlement visibility from initiation to INR credit.

Every transaction is timestamped, tracked, and documented — not as a favor, but as a rule.

This is what changes behavior.

When you can predict inflows, you plan differently.

- You stop padding timelines “just in case.”

- You stop keeping extra float for uncertainty.

- You start trusting your own projections again.

Predictability is the real product HiWiPay sells.

IV. The Ripple Effect of Delay

The real damage of delayed settlements isn’t the inconvenience. It’s the domino effect.

1. Working Capital Compression

A marketing agency billing $50,000 monthly loses three days of liquidity per cycle. Over 12 months, that’s 36 lost working days — more than a full fiscal quarter frozen in limbo.

2. Operational Slack

Every unpredictable inflow forces buffer accounts, credit dependence, and CFO firefighting. Forecasting turns into educated guessing.

3. Reputation Risk

When exporters rely on variable cash flow, even minor vendor delays echo down the chain. Trust erodes quietly, not because of intent — but inconsistency.

HiWiPay erases that uncertainty.

Every incoming payment moves through a deterministic pipeline. Funds arrive when they’re supposed to. Documentation generates automatically. The rhythm of your business stays intact.

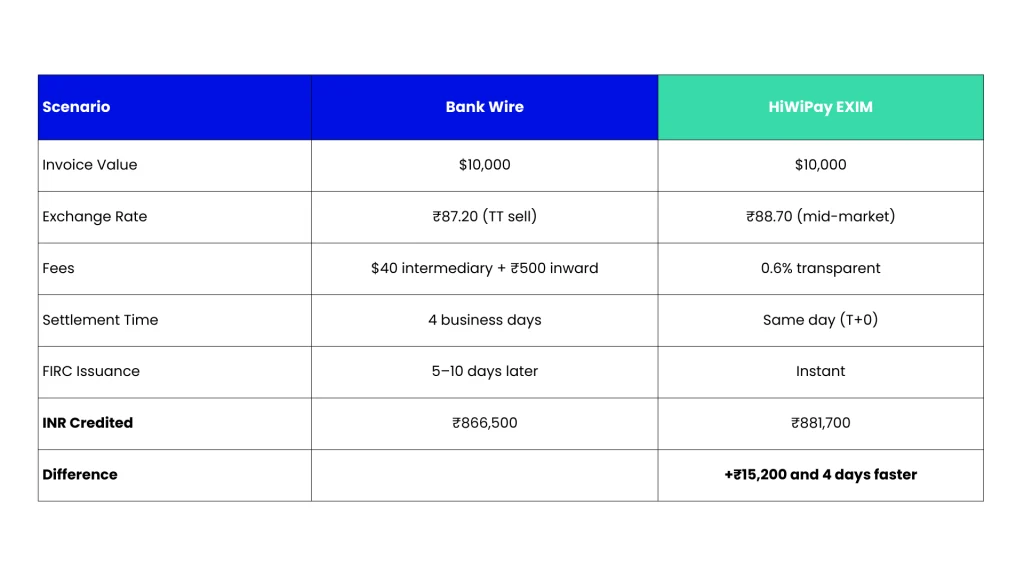

V. A Tale of Two Transactions

Let’s look at the same client payment through two systems.

The numbers explain themselves.

HiWiPay doesn’t just deliver more money. It delivers it when it matters most — now.

VI. Time As Strategy

In exporting, speed is a vanity metric. But consistency is a weapon.

When settlements hit your account with machine precision, you start making moves banks can’t model.

- Paying vendors early to unlock discounts.

- Running leaner treasury operations.

- Forecasting with confidence in pitch decks and funding rounds.

That’s what HiWiPay enables.

Not faster money — smarter business.

VII. The Human Cost of Waiting

Delays don’t just live in spreadsheets. They live in tension.

A founder in Pune once said it best:

“The waiting is worse than the fee. You can’t plan life around ‘should arrive soon.’”

She ran a small export consultancy. Her monthly inflows were stable, but each month’s payment arrived on a different day. Sometimes Thursday. Sometimes the next Monday. Once, two payments landed together after ten days — leaving her with idle cash one week and overdraft interest the next.

After switching to HiWiPay, she knew exactly when to expect credit. Her finance calendar stopped being reactive.

She could plan.

And more importantly, she could relax.

Predictability doesn’t just save money. It saves focus.

VIII. The Mechanics Behind HiWiPay’s SLA

HiWiPay’s guaranteed SLA isn’t marketing optimism — it’s infrastructure math.

The platform’s architecture combines:

- Direct global settlement corridors through JPMorgan Chase and regulated partners in the US, UK, and EU.

- Automated FX engines that lock real-time mid-market rates the moment the remittance hits.

- RBI-aligned compliance tagging that eliminates post-settlement friction for FIRCs and purpose codes.

- 24×7 monitoring systems that track each transaction’s lifecycle, from client initiation to INR credit.

Every variable that causes delay in traditional wires — manual review, intermediary routing, staggered batching — is systematically removed.

It’s not “fintech magic.” It’s engineering discipline.

IX. The Broader Impact

Predictable settlement doesn’t just benefit exporters. It ripples through the entire ecosystem.

For Freelancers and Agencies

It removes emotional volatility. No more “maybe tomorrow” conversations with clients or banks. Every payment follows a timeline you can point to.

For CFOs

It turns accounts receivable into something measurable. You can plan tax filings, GST refunds, and payroll with precision.

For India’s Export Economy

It closes the loop faster — every day a dollar stays abroad, it delays the country’s realized export earnings. Faster settlements strengthen the national current account, not just individual balance sheets.

HiWiPay’s infrastructure isn’t just a business product. It’s part of the invisible plumbing of a faster trade ecosystem.

X. Case Study: The Agency That Stopped Waiting

A creative agency in Bengaluru worked with four international clients. They received an average of $80,000 a month through SWIFT transfers. The delays averaged four days per transaction.

That meant 16 days a month of idle liquidity, not counting the manual time spent chasing FIRCs and reconciling bank statements.

After switching to HiWiPay:

- Settlement reduced from 4 days to 6 hours.

- FIRC issued automatically.

- No intermediary deductions.

- FX visibility improved, raising average realized INR by 1.7%.

The real result wasn’t savings. It was stability.

Their CFO said:

“We stopped managing delays. We started managing growth.”

XI. The Emotional Layer Of Efficiency

There’s something almost philosophical about getting your money on time.

It tells you the system sees you — not as an afterthought, but as an equal participant.

For years, exporters learned to normalize delay as part of the trade cycle. But delay isn’t destiny. It’s design.

HiWiPay redesigned it.

When you can rely on a fixed SLA, you stop bracing for disappointment. The process becomes invisible — as it always should have been.

XII. The Verdict

In the old world, payment delays were acceptable. They were “how it works.”

In HiWiPay’s world, they’re a bug, not a feature.

Bank wires offer hope.

HiWiPay offers a timestamp.

That’s the difference between moving money and moving with certainty.

For exporters, that difference means control, capital, and calm — the three things no spreadsheet can quantify but every founder needs.

About HiWiPay EXIM

HiWiPay EXIM is India’s modern export payment platform that guarantees settlement precision for global earners. Designed for freelancers, agencies, SaaS exporters, and SMEs, it brings together live FX conversion, compliance automation, and same-day settlements in one cohesive system.

Powered by JPMorgan Chase’s global banking rails, built under RBI oversight, and led by Dewang Neralla (founder of Atom Technologies and ex-CEO of NTT Data Payments), HiWiPay EXIM replaces opacity with visibility.

Every transaction follows a fixed SLA: T+0 to T+1, backed by real-time tracking and instant digital FIRCs. Exporters receive INR credits directly into their Indian accounts with mid-market FX rates and no intermediary cuts.

HiWiPay’s philosophy is simple:

Time should compound value, not dilute it.

That’s why HiWiPay doesn’t compete on speed. It competes on certainty — and wins.