Every exporter knows their margins down to the decimal. Freight. Packaging. GST. But almost no one tracks the one cost that leaks silently every month — the money lost between “payment sent” and “INR credited.”

The banks call it an exchange rate. Fintechs call it a fee. You call it “close enough.” But it’s the difference between your revenue and your reality.

HiWiPay built the ROI Calculator for exactly that reason — to show exporters, agencies, and freelancers how much they’ve been losing to hidden FX spreads, SWIFT deductions, and fintech markups.

Because once you see the math, you can’t unsee it.

The Hidden Cost You Never Measured

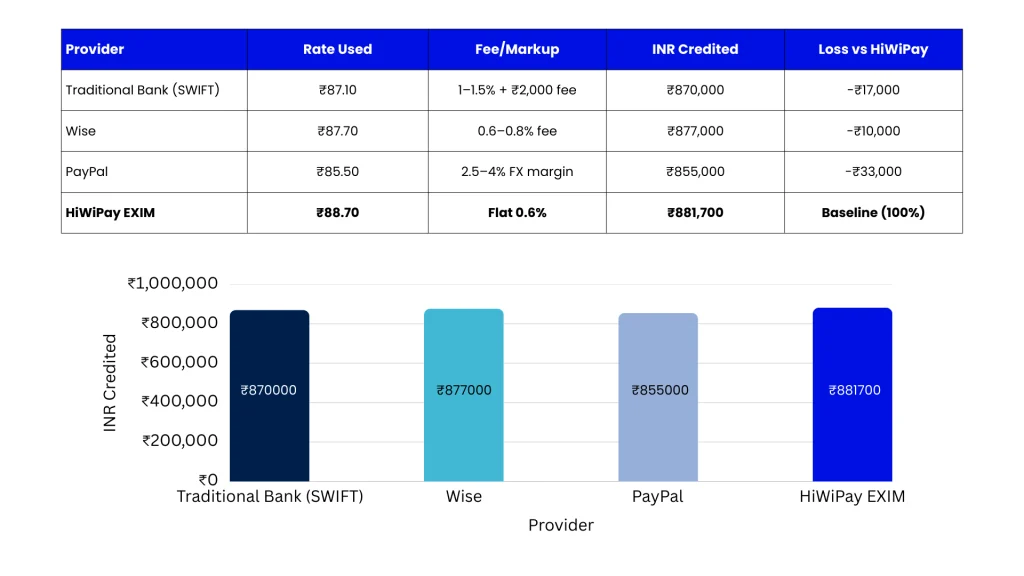

When your client sends $10,000, your bank or PSP doesn’t just convert it — it reshapes it.

That one-rupee difference between ₹87.7 and ₹88.7 costs ₹10,000 on a $10,000 invoice. Over a year of $20,000 monthly inflows, that’s ₹2.4 lakh you’ll never see again.

The ROI Formula for Exporters

Your real ROI on export collections isn’t just how much you earn — it’s how much you keep.

ROI on Receipts = (Landed INR via HiWiPay / Landed INR via Old Method – 1) × 100

Example:

HiWiPay credits ₹8,81,700 while your bank credited ₹8,70,000.

ROI = (8,81,700 / 8,70,000 – 1) × 100 = 1.34% monthly improvement

That may sound small, but across $240,000 annual receipts, it’s nearly ₹2.9 lakh in recovered value.

And that’s before factoring faster settlements, auto-FIRC, and reconciliation hours saved.

ROI That Goes Beyond the Rate

HiWiPay’s ROI isn’t just about FX. It compounds through:

- Time saved: Same-day (T+0 to T+1) settlements free your cash flow faster.

- Compliance built-in: Digital FIRC and e-BRC are auto-generated, saving ₹1,000–₹2,000 in manual processing per transfer.

- Clarity: Live mid-market rates remove guesswork from forecasting.

- Control: All your transactions, currencies, and FIRCs live in one dashboard.

When you combine all of it, HiWiPay’s ROI isn’t theoretical — it’s measurable in hours, rupees, and sanity.

Why Most Exporters Never See This

Banks make their FX margin invisible by showing you “preferential rates.” Fintechs call their spreads “low-cost transfers.” Both rely on you not checking the math.

HiWiPay built transparency into its core. You see the live market rate before conversion, and your INR matches it. Every time.

The ROI Calculator quantifies that clarity. It turns every saved rupee into visible proof.

The Verdict

You can’t optimize what you don’t measure. The HiWiPay ROI Calculator shows exactly how much your current payment route costs you — in rupees, hours, and opportunities.

For exporters chasing scale, those invisible margins are the difference between growing fast and growing profitably.

HiWiPay doesn’t just help you earn more. It helps you keep more.

About HiWiPay EXIM

HiWiPay EXIM is India’s next-generation export payment platform designed for clarity, compliance, and control. It helps exporters, agencies, and freelancers receive global payments at live mid-market FX rates, without hidden spreads or SWIFT friction.

Each transaction runs on JPMorgan-backed banking rails with T+0 to T+1 settlements, instant digital FIRC generation, and built-in RBI compliance. HiWiPay’s dashboard acts as a control tower for exporters — tracking receipts, matching invoices, reconciling books, and storing all documentation in one place.

Developed by Dewang Neralla, the fintech veteran behind Atom Technologies and NTT Data Payments, HiWiPay combines institutional reliability with startup speed. It’s built for exporters who want to measure their business by landed INR, not assumed rates.

Transparent. Fast. Fully compliant. HiWiPay EXIM makes your global income feel local again.