You built a brand that travels faster than shipping containers. Your product leaves India in hours. Your marketing reaches five continents in seconds. But your money? It still takes the scenic route home.

Every D2C founder knows the drill—Shopify dashboard glowing green, sales flooding in, orders shipping out. But when it’s time to get paid, your earnings crawl through a maze of PSPs, intermediaries, and FX markups. By the time your dollars reach your INR account, they’ve been chewed, taxed, delayed, and diluted.

That’s the silent heartbreak of global success—your margins vanish somewhere between “Payment Captured” and “INR Settled.”

HiWiPay was built for that heartbreak. It doesn’t just move your money faster—it keeps it whole.

The Cost of Selling Globally, Paid Locally

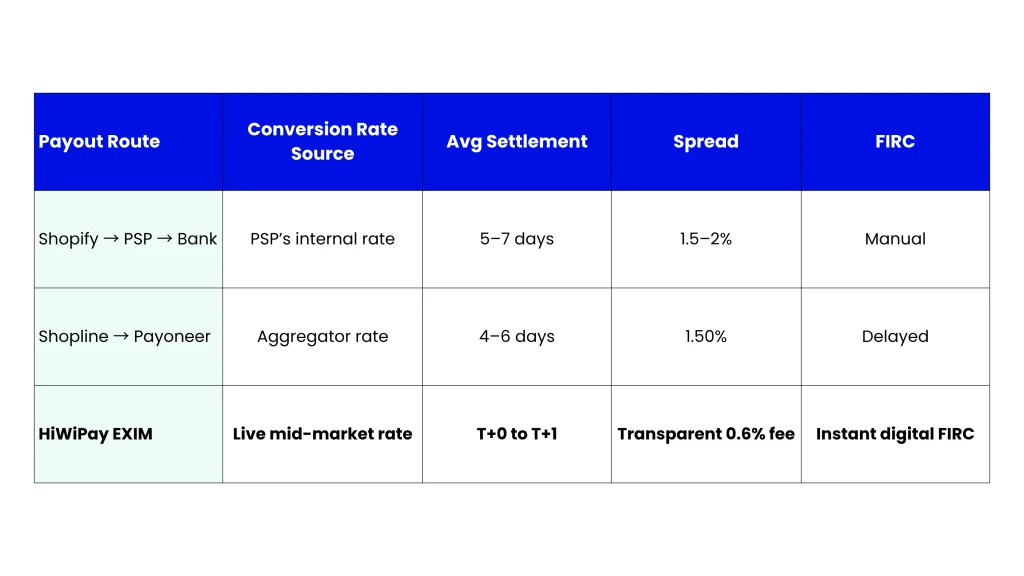

Shopify and Shopline make it easy to sell worldwide—but not to settle worldwide. Their payout chains rely on partner PSPs (like Payoneer, Stripe, or WorldFirst) that run on old-school FX models and SWIFT corridors designed for banks, not brands.

For every $1,000 in sales, here’s what really happens:

- 1.5–2% quietly disappears as FX spread.

- Another $20–$30 goes to “processing.”

- And your payout takes 4–7 business days to show up.

What’s left is not your revenue—it’s a discounted version of your success.

HiWiPay clears that bottleneck by doing what your storefront already does: working in real time.

When Speed Becomes Strategy

Let’s talk numbers.

A Delhi-based D2C apparel label doing $25,000/month through Shopify was losing ₹28,000–₹32,000 each cycle purely to conversion gaps and delay-based liquidity loss.

After switching to HiWiPay, the same inflows settled at mid-market FX rates, hit their INR account within hours, and generated digital FIRCs instantly. Their margins jumped 1.8%. Their ad spend doubled. Their cash flow stopped dragging.

It wasn’t a new campaign that grew their profits—it was fixing how the money moved.

The Real Battle: Control

Global D2C isn’t a game of product anymore—it’s a game of control. You already control your packaging, pricing, and brand voice. But when your settlement depends on a faceless PSP, you’ve handed over your financial tempo.

HiWiPay gives it back. It syncs payouts directly to Indian banks through compliant local corridors, locks FX rates in real time, and auto-issues FIRCs without a single email chain. You know your exact landed INR before you even fulfill the order.

That kind of control doesn’t just improve accounting—it changes how you scale.

Why D2C Brands Stick with HiWiPay

Because they stop feeling like exporters and start feeling like CEOs.

HiWiPay turns cross-border settlement into a dashboard experience—live rates, live settlements, live proof.

Every dollar that hits your account arrives faster, cleaner, and with its full story attached.

The Verdict: Growth Deserves a Shortcut

You built your brand to move fast. HiWiPay just makes sure your money does too.

The old way—PSPs, delayed SWIFT transfers, missing FIRCs—isn’t just outdated, it’s disrespectful to the pace at which modern D2C founders operate.

HiWiPay bridges that gap between selling global and settling local. Because if your product can go from Delhi to Denmark overnight, your payout should too.

About HiWiPay EXIM

HiWiPay EXIM is the payment engine behind India’s new export brands—Shopify, Shopline, and global D2C sellers who’ve outgrown bank wires. It merges real-time FX, instant INR settlements, and automated FIRC documentation into one clean flow.

Your brand deserves a payout system built for the world it sells to—not the one it left behind