If cross-border payments were a chess game, banks have been playing exporters for decades—quietly taking the queen while distracting you with pawns labeled “processing,” “TT sell,” and “bank rate.” The board looks fair, but every move costs you a few invisible rupees.

Send $10,000 from New York, €10,000 from Berlin, or £10,000 from London, and by the time it lands in your Indian account, it’s been nibbled by three middlemen, a SWIFT fee, and a mysterious 1.5% “forex adjustment.” What should have been a clean conversion at ₹88.7 becomes a slow bleed at ₹87.1—and the bank still smiles, saying you got a “preferential rate.”

For exporters, those decimal points are destiny. Across the USD, EUR, and GBP corridors, what you lose in spreads and delays is more than just bad math—it’s lost cash flow, lost trust, and lost control.

HiWiPay flips the board. No hidden spreads, no corridor tolls, no guessing games—just live mid-market rates, instant settlement, and full visibility on every rupee your client’s currency becomes.

The Anatomy of Bank Pricing: Death by a Thousand Deductions

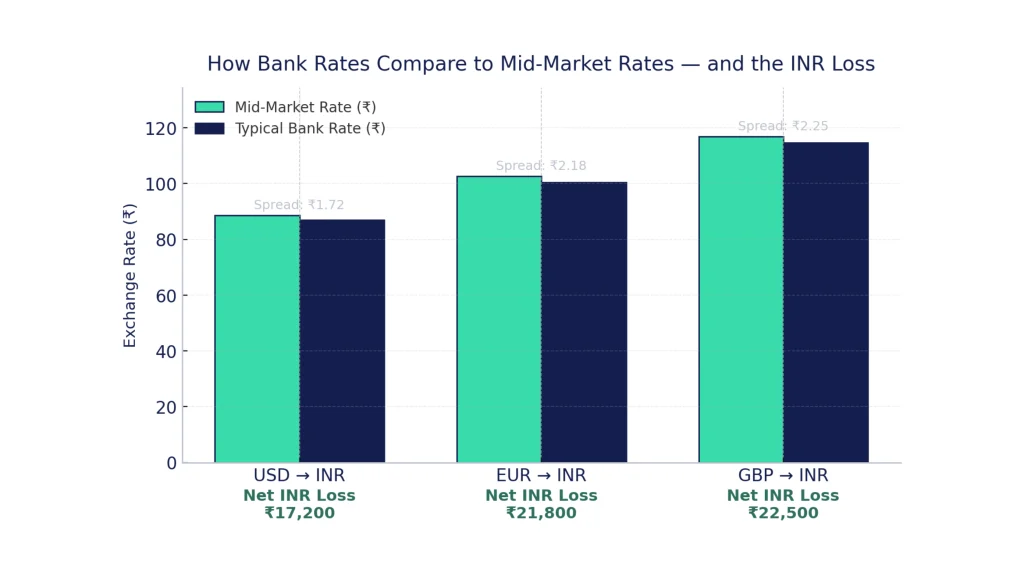

Banks rarely charge “fees” outright anymore. Instead, they bake their profits into exchange rates. The published forex USD to INR mid-market rate might be ₹88.72, but your bank quietly quotes ₹87.00 or ₹87.20—1.5–2% lower than reality. That’s how they make their margin while claiming “zero remittance charges.”

On a $10,000 export receipt, that single rupee slip means roughly ₹10,000 lost—even before adding SWIFT fees of $25–40, intermediary bank cuts of $10–$20, and local receiving fees (₹150–₹300). The total loss easily crosses ₹15,000–₹17,000 per transaction.

It’s the same story across corridors. Whether your clients pay from New York, Berlin, or London, the system quietly penalizes you for trusting “bank rate India.”

What HiWiPay Does Differently

HiWiPay’s conversion model runs on mid-market linked rates—the same benchmark you see on Google or Reuters. There’s no internal markup, no “preferred slab,” and no waiting for a relationship manager to quote “today’s rate.”

For a $10,000 USD transfer:

- Bank: ₹87.00 × 10,000 = ₹870,000 minus fees = ~₹865,000 credited

- HiWiPay: ₹88.72 × 10,000 – 0.6% transparent fee = ~₹882,000 credited

That’s a ₹17,000 difference on one payment. Over 12 months, even a mid-sized agency receiving $25,000/month can save ₹4–5 lakh a year purely on conversion efficiency.

And because HiWiPay connects directly to local settlement partners, there’s no SWIFT relay or intermediary loss. Payments settle within T+0 to T+1, meaning exporters get working capital faster—often same-day for USD, EUR, and GBP inflows.

Corridor Deep Dive: USD, EUR, GBP

USD Corridor

Banks dominate this lane, but each transfer typically crosses two correspondent banks before reaching India. Each step adds both cost and delay. HiWiPay bypasses SWIFT entirely, matching the client’s payment to an India-bound corridor in real time. Result: same-day INR credit, mid-market USD to INR convert, and instant FIRC.

EUR Corridor

European banks often reroute SEPA transactions through SWIFT for India, adding €20–35 in extra charges and cutting ₹1–1.5 off the rate. HiWiPay maintains local EUR→INR corridors—no extra routing, no hidden spreads, and predictable landed INR.

GBP Corridor

UK wires tend to lose value via dual routing (London → Frankfurt → Mumbai). HiWiPay processes GBP locally, using direct FX conversion into INR with full transparency. Exporters typically gain ₹12,000–₹15,000 more per £10,000 receipt compared to a standard SWIFT path.

Beyond Rates: FIRC and Compliance Without the Chase

Ask any exporter what really slows them down, and they’ll mention FIRC paperwork. Banks still issue it manually, often days or weeks after settlement. Purpose codes mismatch, signatures go missing, and reconciliation takes forever.

HiWiPay automates it. Each transaction generates a digital FIRC (or e-BRC) instantly, mapped to the right purpose code under RBI rules. No follow-ups, no emails, no branch visits. For exporters managing multiple invoices, this isn’t a feature—it’s freedom.

The Verdict: Precision Pays

Traditional banks trade opacity for loyalty. You stay because you think “it’s safer.” But every month, that safety premium quietly compounds into real losses. HiWiPay replaces that opacity with clarity—mid-market conversions, instant settlements, auto-FIRC, and a transparent cost per corridor.

In a world where exporters live and die by margin, this isn’t just fintech convenience. It’s financial discipline disguised as efficiency.

About HiWiPay EXIM

HiWiPay EXIM was built for the exporters who’ve done everything right—closed deals, shipped work, filed invoices—only to find the system took its cut on the way home. It’s a platform that doesn’t just move money; it moves power back into the exporter’s hands. With live FX feeds, compliance-ready FIRC, and corridor-specific pricing across USD, EUR, and GBP, HiWiPay ensures your foreign currency lands in India exactly how it should: clean, compliant, and complete.