The export payment lands. The client says thank you. You exhale. For a moment, everything is perfect.

Then someone in finance opens the FIRC request form. The silence that follows feels like a warning.

“Which purpose code did we use last time?”

No one answers.

That’s how compliance starts slipping — not in fraud or neglect, but in small, quiet uncertainties. A dropdown chosen in a hurry. A mismatch that no one catches. A refund stuck months later.

HiWiPay was designed for that silence. For the ten seconds between “payment received” and “are we sure this is compliant?”

When Compliance Is Left To Luck

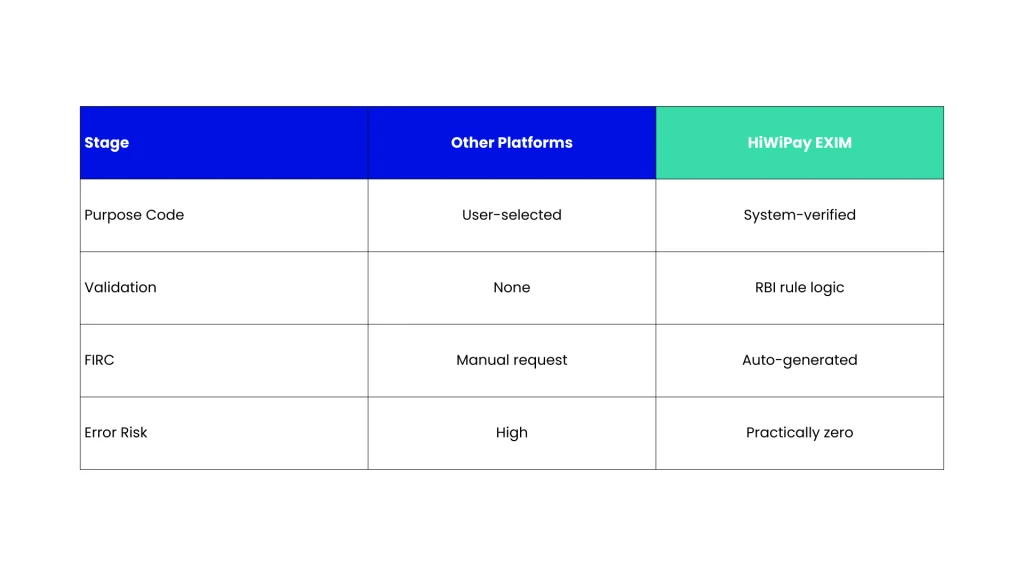

Most platforms call it self-serve compliance.

Translation: You’re on your own.

A freelancer picks Software Export. An agency picks Consultancy Services. A SaaS founder picks both at different times.

The systems accept them all, because their job ends at “transfer successful.”

But regulators don’t forgive ambiguity. The RBI doesn’t look at your UI, it looks at your ledger.

That’s where most exporters lose weeks, refunds, and confidence.

HiWiPay replaces that uncertainty with certainty coded into every transaction.

What Purpose-Code Assist Really Does

It doesn’t wait for you to choose. It knows.

When a remittance hits HiWiPay, the platform reads the nature of your service, the corridor, the client profile, and automatically applies the correct RBI purpose code.

Before the conversion. Before settlement.

You don’t touch a dropdown. You don’t hope someone picks right.

The code is attached, verified, and locked with the payment itself.

Then the FIRC generates automatically — same day, clean, compliant, and ready for every audit trail that follows.

HiWiPay doesn’t make compliance faster. It makes it inevitable.

One Wrong Code, One Long Delay

A design firm in Pune billed a US client for marketing strategy. Their PSP filed it under Software Export.

Three months later, their refund claim was rejected. They spent seven weeks writing clarification letters for something that started with one wrong click.

When they shifted to HiWiPay, every export was pre-tagged correctly. Their FIRCs matched their invoices. Their books balanced without intervention.

They didn’t have to become compliance experts. Their system already was.

The Quiet Power Of Getting It Right

Compliance isn’t supposed to feel like chaos control. It’s supposed to feel like breathing — constant, invisible, right every time.

That’s what HiWiPay built. A platform where no one ever asks “which purpose code” again.

It’s not about making rules simple. It’s about making them disappear behind precision.

About HiWiPay EXIM

HiWiPay EXIM is India’s export-native payment platform created for service exporters who don’t have time to second-guess their paperwork. It processes cross-border receipts through live mid-market FX, auto-mapped RBI purpose codes, and instant digital FIRCs.

Every transaction runs on JPMorgan-backed rails, governed by ex-RBI oversight, and developed under the leadership of Dewang Neralla — the technologist behind Atom Technologies and NTT Data Payments.

For exporters, that means one thing: compliance becomes architecture, not effort.

Purpose codes map automatically, FIRCs appear without follow-up, and every export stays RBI-clean by design.

HiWiPay EXIM isn’t where you fix compliance. It’s where you stop worrying about it entirely.