Reconciling export payments manually is like debugging code written by five different developers—each one using a different language, format, and logic. The CSV says one thing, the bank report another, and your FIRC certificate arrives as if it’s from a parallel timeline. You spend hours patching mismatched invoices, converting currencies, and re-uploading data that should’ve […]

Category: Blog

Your blog category

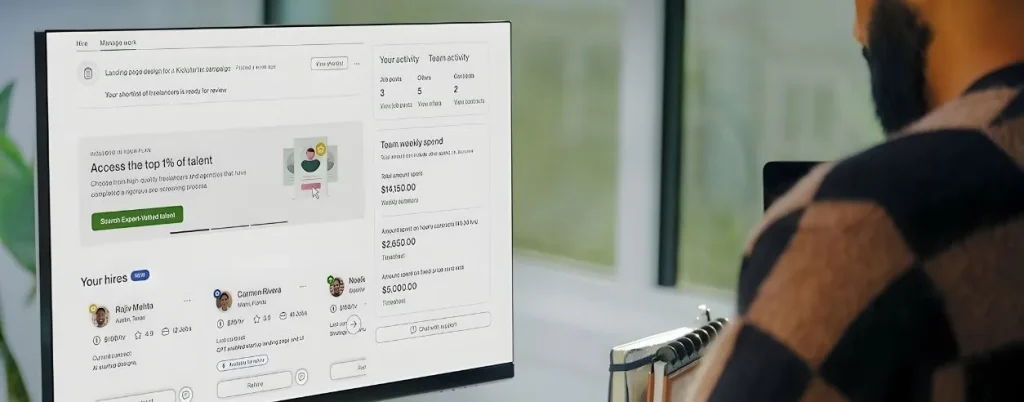

HiWiPay for Upwork/Fiverr Freelancers: Workflow & Fees vs Platform Routes

If you’ve ever freelanced long enough, you know the heartbreak of watching your hard-earned $1,000 turn into ₹81,000 instead of ₹83,000—and no one tells you why. The platform blames the processor, the processor blames the bank, and by the time the money lands, you’ve already lost a day’s rate and a few hundred rupees in […]

Case Study: FIRC Turnaround—HiWiPay vs Marketplace Payouts

For Indian exporters, waiting for a FIRC can feel like waiting for monsoon rain—you know it’ll come, you just don’t know when. The work’s done, the payment’s received, and yet your GST refund or incentive claim sits frozen because that one piece of paper—the Foreign Inward Remittance Certificate—hasn’t landed. Marketplaces promise global reach. But when […]

Case Study: ₹ Savings with HiWiPay at $50k/Month vs Bank Wire

If international payments were a relay race, banks would be the runner who starts fast, drops the baton midway, and still charges you for the medal. You send $50,000 from your client every month, expecting a clean INR conversion. But somewhere between the sender’s bank, two intermediaries, and your local branch, the payout loses steam […]

HiWiPay EXIM vs Traditional Bank Forex Charges: A Detailed Comparison

If cross-border payments were a chess game, banks have been playing exporters for decades—quietly taking the queen while distracting you with pawns labeled “processing,” “TT sell,” and “bank rate.” The board looks fair, but every move costs you a few invisible rupees. Send $10,000 from New York, €10,000 from Berlin, or £10,000 from London, and […]

HiWiPay vs PayPal for Agencies: FX Spread, TCS & FIRC Explained

PayPal was the first passport Indian agencies ever owned.Long before the fintech wave, before dashboards, before T+0 became a thing, it was PayPal that made “foreign client” sound real. You’d get that email, “You’ve got money” and for a second, it felt like the world was smaller. But nostalgia has exchange rates too.Because what started […]

Payoneer Alternatives for Indian Marketplace Sellers: HiWiPay Comparison

Your products live in warehouses you’ve never seen.Your customers live in cities you can’t pronounce.And your money? It lives somewhere in the space between platforms, payment partners, and time zones. Marketplace selling was supposed to feel borderless—until you realised your cash flow still needs a visa. You sold a mug to Madrid, a kurta to […]

Wise Alternatives for Indian Freelancers: Why Choose HiWiPay

Remember when getting paid meant walking to a counter, signing a slip, and leaving with proof in your hand? Now the counter lives inside an app, the signature is a click, and the proof takes three business days to reach your bank. Freelancers went remote.Payments didn’t. 1. The New Freelance Equation Today’s freelancers are global […]

HiWiPay vs Bank SWIFT: When to Switch From Your RM (Cost, Speed, Docs)

For decades, international payments ran on a simple handshake.You’d walk into your bank, meet your relationship manager, sign a few forms, and trust that your client’s dollars would find their way home. It was personal. Predictable. Human. That handshake still matters, it built the trade economy we stand on.But as business scales and borders blur, […]

HiWiPay vs Payoneer: Fees, Settlement Speed & Accounting Sync

If you trace an exporter’s day on a graph, it wouldn’t chart profit, rather, it would chart time.Time between invoice and credit.Time between an email marked payment sent and an INR notification that finally confirms it.Platforms like Payoneer helped smooth that curve — fewer steps, fewer surprises.But sometimes, even smooth can still be slow. HiWiPay […]