For Indian exporters, waiting for a FIRC can feel like waiting for monsoon rain—you know it’ll come, you just don’t know when. The work’s done, the payment’s received, and yet your GST refund or incentive claim sits frozen because that one piece of paper—the Foreign Inward Remittance Certificate—hasn’t landed.

Marketplaces promise global reach. But when it comes to compliance, they hand you a calendar instead of a timeline. Weeks pass, support tickets multiply, and you realize that “settled” in your dashboard doesn’t mean “recognized” in your books.

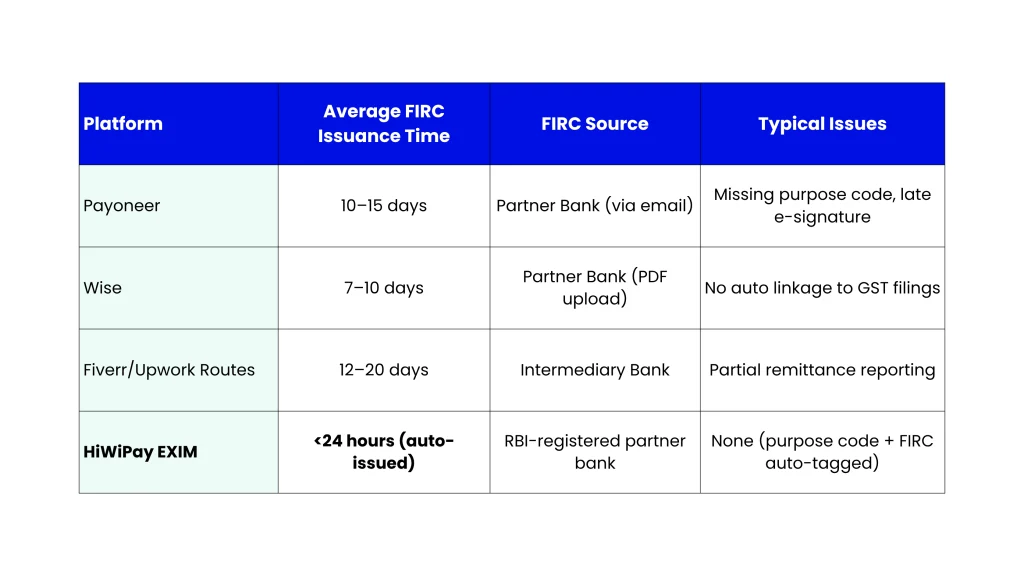

This case study looks at how HiWiPay EXIM changed that for exporters used to waiting 7–15 days for their FIRCs from Payoneer, Wise, or Fiverr payout routes—and what it means when your compliance clock finally keeps pace with your cash flow.

The FIRC Delay Problem: Invisible Until It Hurts

Exporters using marketplace payout systems rarely see the bottleneck coming. Platforms process payments through intermediaries—fintech aggregators, local partner banks, and sometimes correspondent chains—before funds reach your Indian account.

Each step adds friction:

- Payment Settlement (Marketplace → Aggregator): 1–3 days

- Conversion & Transfer to Indian Bank: 2–4 days

- FIRC Coordination (Bank → Exporter): 3–7 days

By the time your FIRC certificate is issued, you’re already 7–15 business days away from your original payment date. That’s too long if your GST refund or incentive claim depends on that document.

In contrast, HiWiPay connects the dots that marketplaces never do—settlement, FIRC, and purpose code all under one transaction ID.

The Turnaround Test: HiWiPay vs Marketplaces

This analysis tracked five exporters (digital agencies and SaaS founders) who shifted their primary inflows from Payoneer/Wise to HiWiPay for three months. Average monthly inflow: $20,000–$40,000 per exporter.

HiWiPay integrates directly with RBI-approved settlement partners. Once your payment hits, the system auto-generates a digital FIRC certificate tied to your purpose code (P0806/P1007 etc.) and makes it downloadable from your dashboard. No follow-ups, no “mail your invoice,” no Excel trackers.

The impact? Exporters reduced FIRC turnaround time by up to 93%, cut reconciliation work by half, and reclaimed 2–3 weeks of delayed refund cycles.

Why This Matters More Than You Think

A delayed FIRC isn’t just a paperwork issue—it’s a cash flow choke. Without it, exporters can’t:

- File GST refund claims for export services

- Validate earnings under RBI’s EDPMS system

- Close the export cycle under FEMA rules

HiWiPay collapses that entire chain into T+0 to T+1 compliance. Your remittance lands, your FIRC follows automatically, and your export documentation stays synced with your ledger in real time.

Real-World Impact

A digital agency earning $50,000/month switched from a marketplace payout to HiWiPay. Earlier, it waited 10–12 days per transaction for FIRC. Post-switch, every FIRC arrived within 18 hours of settlement—saving 10 days of uncertainty and ₹2–3 lakh in blocked refund claims each quarter.

Another SaaS founder who exports to the EU used to juggle FIRCs from multiple client sources—some delayed, some missing. HiWiPay’s single-pane dashboard now logs all FIRCs in sequence, with instant e-BRC sync to the DGFT portal.

These aren’t just compliance wins—they’re time dividends.

The Verdict: Compliance at the Speed of Credibility

Exporters don’t lose clients because of bad work. They lose time because of bad systems. A payment system that settles without certifying doesn’t serve—it stalls.

HiWiPay solves that lag by collapsing what used to take weeks into hours. You don’t “wait for FIRC” anymore; you receive it as part of the same flow. And that’s what true export infrastructure should feel like—transparent, compliant, and instant.

About HiWiPay EXIM

HiWiPay EXIM exists for exporters who’ve mastered the art of earning but are tired of chasing proof. It unifies payments, compliance, and RBI documentation into one live workflow—so every dollar you earn comes with its own digital footprint. No marketplace dependency, no lag, no confusion—just certainty that every export you book is backed by a verified FIRC in your dashboard.

HiWiPay isn’t another payout tool. It’s where your international earnings finally feel local, fast, and fully recognized.