If international payments were a relay race, banks would be the runner who starts fast, drops the baton midway, and still charges you for the medal. You send $50,000 from your client every month, expecting a clean INR conversion. But somewhere between the sender’s bank, two intermediaries, and your local branch, the payout loses steam and rupees.

This case study follows that lost value step by step. Not hypotheticals, but real math from exporters who shifted their $50k monthly inflows from bank wire transfers to HiWiPay’s mid-market corridors.

The Baseline: How Banks Turn $50k into ₹40.5 Lakh Instead of ₹41 Lakh

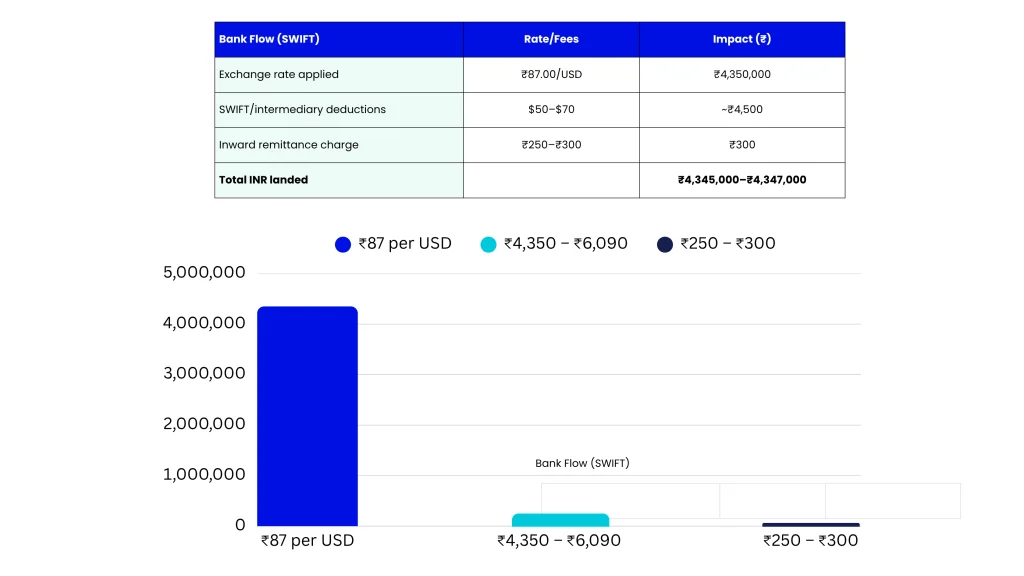

Here’s what typically happens:

Your client wires $50,000 via SWIFT. On paper, you should receive ₹88.7 per dollar (the live mid-market forex USD to INR rate). But your bank applies its internal “TT sell” rate—₹87.3, maybe ₹87.0 on a bad day.

That ₹1.7 gap doesn’t sound huge until you multiply it.

You just lost roughly ₹55,000 on one $50k transfer—₹50,000 from rate spread, ₹5,000 from fees. Over a year, that’s ₹6.6 lakh silently disappearing into the system.

And if your clients are in Europe or the UK? Add another ₹10–15k monthly in SEPA-to-SWIFT routing losses.

The HiWiPay Route: No Spread, No Guesswork, No Waiting

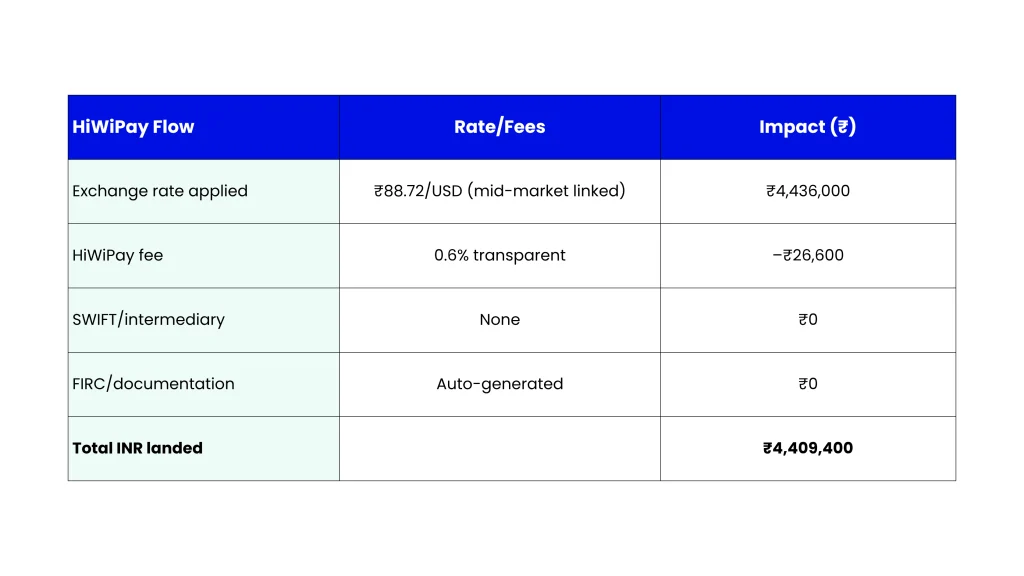

HiWiPay doesn’t play with “bank rate India” markups. Its model uses the live mid-market forex rate, visible in-app, updated in real time. You see the exact conversion before you hit “accept.”

Let’s replay the same $50,000 receipt through HiWiPay.

That’s roughly ₹62,000 more per month compared to a bank wire. No waiting, no deductions, no hidden FX spread. Over 12 months, this single correction compounds into ₹7.4 lakh in recovered value—the kind of “invisible revenue” most exporters never realize they’re losing.

Speed, Compliance, and Sanity

Banks love a slow dance. A typical SWIFT settlement (USD→INR) takes T+2 to T+4 days, and FIRC issuance takes longer still. HiWiPay compresses that entire cycle into T+0 to T+1, with the FIRC automatically attached to your settlement report. No RM follow-up, no “mail your purpose code,” no GST reconciliation chaos.

This speed isn’t just convenience—it’s capital efficiency. The faster your payments clear, the faster you can recycle cash into operations, payroll, or growth.

How It Adds Up Over Time

Even conservative exporters—those doing $20k–$30k a month—stand to gain ₹3–₹5 lakh annually just by switching the corridor.

The pattern holds across currencies. Whether it’s USD to INR, EUR to INR, or GBP to INR, the math always ends with one truth: spreads cost more than you think, and speed multiplies the impact.

The Verdict: You Don’t Need to Negotiate for Transparency

Bank relationships run on inertia. Most exporters don’t leave because they assume all systems leak equally. But HiWiPay’s proof is arithmetic, not optimism. It trims the waste from each wire, adds visibility to every INR, and builds compliance into the transaction instead of stapling it later.

So if you’re receiving $50k a month and still settling via traditional SWIFT, you’re not just losing spread—you’re funding it.

About HiWiPay EXIM

HiWiPay EXIM wasn’t designed to compete with banks; it was designed to outgrow them. For exporters and agencies handling steady inflows, HiWiPay merges mid-market FX pricing, instant INR settlement, and one-click FIRC generation under a single interface. No waiting for branch approvals, no chasing RMs, no “today’s rate” surprises—just precision-built control over how every dollar, euro, or pound lands in your ledger.

When your cross-border cash flow runs at $50k a month, predictability isn’t a feature—it’s profit.